Is it Possible to Improve on “Crossing the Chasm”?

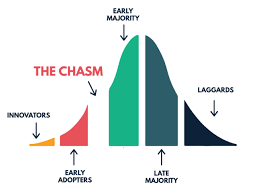

adminComments off.I’m with Malcolm Gladwell on this…”Crossing the Chasm” by Geoffrey Moore is likely the best business book ever. Its been a continual reference source for me throughout my career. And over 25 years after its first publication, its still 100% relevant today. In just the past few weeks, I’ve had several detailed strategy discussions with executives and investors that referenced “Crossing the Chasm” principles.  The Chasm model has become a nearly universal benchmark for categorizing a technology company’s position in the market, as well as providing a Get-to-the-Early-Majority prescription for success.

The Chasm model has become a nearly universal benchmark for categorizing a technology company’s position in the market, as well as providing a Get-to-the-Early-Majority prescription for success.

In “Crossing the Chasm“, Moore uses the Allied Forces D-Day strategy as an analogy. The Allied Forces could not take Paris if they didn’t first take Normandy. The Allies committed an over-abundance of support and focus into a confined niche – and won that niche. That in turn provided the position and leverage to challenge and win the next target. “Crossing the Chasm” prescribes the same formula for businesses. For technology companies trying to cross the chasm, the key to selecting the niche, or market segment is picking one that’s big enough to matter, small enough to win, and one that values a company’s ‘crown jewels. Just as the Allies did, commit an over-abundance of resources (sales, marketing, support and product) to the targeted segment. Win the targeted segment, select the next target, advance.

So, given this market proven formula, with literally hundreds of successful case studies over 25+ years, why is it so hard to for marketers, executives, and investors to commit to the Chasm strategy? Why do only 37% of companies survive more than 4 years, especially when so many of them had superior technology in their category? Even Google has had products that failed to make the crossing (Glass, Buzz, Wave, Answers…).

Based on personal experiences, I think there are two primary reasons companies don’t successfully cross the chasm:

1. FOMO (fear of missing out) Sales Risk

2. Target Market Selection and Commitment Risk

“Crossing the Chasm“: Triggering Sales FOMO

Let look at FOMO first. The reason companies reach the Chasm in the first place is because they had success with early adopter customers. Early adopter customer bases are largely sales driven. Sales people canvass across a broad universe of potential prospects and uncover those with the risk-dispositions and technology adoption profiles that lead to early sales. Early adopters transcend market segments – they exist across all markets yet represent a very small percentage of the market. And nearly every reasonably sized enterprise with a technology engineering budget is a target. Marketing at this stage tends to be non-market specific, feature / function based, and generalized with respect to business benefits. And that’s usually good enough at this phase, because early adopter buyers skew towards technology savvy. One of their prime attributes is that they’re willing to figure out the value of your product on their own.

The Chasm success model tells us we must change our selling strategy completely in order to cross the chasm. In fact, Moore tells us “the consequences of being sales driven during the Chasm period are fatal.” This sales transition is not to be underestimated. ‘Big-game hunters’ thrive on the competitive challenge of winning early customers, they feed off the ego boost of highly celebrated wins, love the intellectual challenge of fitting into the early adopter’s vision, and are likely rewarded for hitting home runs, rather than singles and doubles.

So, there’s a marketing and sales alignment reality that chasm crossing marketers must confront: ‘redirecting’ salespeople who had free market reign and who have likely made a lot of money doing exactly the opposite of what’s required to cross the chasm. It’s a setup for sometimes nasty battles between sales and marketing. Get the CEO and investors on board you say? Based on personal experience, I haven’t worked with a single CEO who didn’t go a little wobbly on the Chasm strategy when a sales person walks in waiving a potential new nameplate deal that’s completely off the target market radar. And the first time your top sales person crashes and burns with a target market prospect?? Forget about it!

The alternative to target market pursuit is to continue a cross-industry pursuit path, effectively chasing sales. The outcome of this approach is predictable, dire, and too often realized – the incremental costs of sales, support, and product engineering from a diminishing number of new customers quickly outweigh the associated revenue. Revenue projections are missed, capital is exhausted, engineer and developer workloads are defined by customer commitments, sales people leave, product evangelists become disillusioned, the moral of those left will spiral down, and likely – senior management will be replaced.

But marketers can never forget – the sales people who’ve made it this far have done deals. Highly visible deals. Their influence at the strategy table is significant. And the most fundamental aspect of the chasm crossing strategy suggests their target prospects, selling strategies, and compensation plans have to change. Perceived limiting of targets. Narrow the pitch to highlight the crown jewels. Minimize free-lance selling. And use Salesforce! FOMO poses a significant marketing and sales (and therefore company) alignment challenge during the chasm cross.

Target Market Selection: The Low Data / High Risk Exercise

The second, and much higher risk issue for the marketer is the target market selection process. This is acknowledged as the most significant challenge of the “Crossing the Chasm” model – a critical decision from which all future actions hinge: identification and selection of the initial target market segment. Because the niche market decision is admittedly a low data decision, it is therefore largely subjective. It’s a huge bet that takes unwavering commitment to execute. And the potential of choosing incorrectly weighs heavily, as there may not be time and capital enough to recover.

The prescription from Moore is reflective of the fundamental challenge in most early market segmentation, positioning, and messaging strategies. The niche market selection exercise is almost wholly dependent on two sources of input: 1) limited experiential data we have from early adopter customers; and 2) and internal perspectives/intuitions of value. Moore’s prescription for target market identification is creation of use case scenarios that in turn inform target customer profiles. Those customer profiles are then evaluated and compared for ‘viability’. The challenge is that the sources of information used to create target customer profiles is either incomplete (i.e. CRM data) or comes from best guesses of highly biased insiders. The risk is embodied in the very profile of small companies competing in early adopter markets – they simply don’t have the skill, time, money, or completeness of information to fully evaluate multiple potential target markets.

So, no matter how effectively we coordinate internal resources and collect available data in our quest to define the ideal initial target market segment, the exercise is acknowledged as one of low data and high risk. Often perspectives of early customer-achieved value with products is driven by individual inputs: what sales thinks vs. engineering vs. support, etc. Subjective, biased, and highly emotional.

1. Our ‘systems of record’ do not provide enough information depth: CRM, sales personnel, customer support, 3rd party databases etc. provide random, subjective and incomplete bits of data.

2. The sales person’s perspective, which reigns large, is limited. They are not market researchers, and they likely touched only a small number of the decision makers, influencers, and users during the early adopter sales process. Their job in the early adopter market is to sell and move on, so understanding downstream value of products to users is not part of their charter.

3. The support organization (including engineering and product development) typically touch problems. They rarely gain product value context…and even if they do, capturing and cataloging is a shortcoming of most early stage technology companies.

4. Marketing often does not have the time, resource, and frankly, the expertise to conduct customer focus groups or to develop and execute studies that that deliver statistically valid data that uncovers the post-sale value that individual users experience.

5. Qualitative studies performed by non-professional researchers have as much chance of leading us away from viable niches as towards them.

Reducing FOMO and Improving the Low Data / High Risk Target Market Decision Process with Analytics

“It is the rare marketer who can persuade the highest paid product evangelist or most successful sales person in the room without data!” Tom Prosia, BeMarketDo

Over the past few years, the emergence of marketing analytics has helped marketers manage the low data / high risk market targeting process. As analytics evolve, the marketer’s ability to translate data into decisions, meaningful interactions, and impactful business outcomes is no longer a dark art. And perhaps most importantly, analytics-driven data provides the marketer a quantitative, fact-based foundation that reduces the subjectivity and emotion that comes with target market selection. Quantitative analytics data also establishes decision baselines we can use for checkpointing and refinement as we encounter the realities of the target market.

Marketing-specific analytics solutions quantify and improve:

• Market segmentation and targeting decisions

• Personalization strategies

• Sales team buy-in (conversion ratio improvements = same/better earnings from target markets)

• Target market refined messaging and positioning

Even when assessing early markets, analytics-driven studies can be highly comprehensive processes, significantly reducing the risk of traditional target market selection techniques. Analytics can deliver detailed insights from customers and prospects that turn low-data, risk-heavy ‘best-guesses’ into informed, fact-driven decisions. In addition, evolved marketing analytics tools can uncover personal resonance factors held by current and prospective customers, cross indexed by market segments, geography, company size, and many other factors. And research tells us personal resonance factors have 2X the impact on B2B decision making as business factors.

Qualitative vs. Quantitative Research

For the marketer, understanding the differences between qualitative and quantitative research is very important. Any type of subjective decision making by the marketer, while courageous, is open to challenge: by the Board who may have their own target market thoughts, by the sales team may will fight the perceived market restrictions, and by the executive team (see ‘wobbly’ above).

Companies often employ qualitative research in an attempt to capture data that will guide target market decisioning. Unfortunately, qualitative research for this purpose is almost always a false hope.

The effective construction of any multi-variant survey is complex and requires expertise. Qualitative surveys are nearly impossible to quantify as statistically sound: results are more subjective and anecdotal. In short, qualitative research does very little to reduce the low data / high risk target market decision…and in fact, may do more harm by creating false expectations for outcomes. Certainly, expectations with executives, sales, and the board will be set for the actionable insights an analytics process will yield. To miss not only consumes time and resources, it’s creates a credibility issue. We marketers stand to lose exactly what we’re trying to gain as a coax our companies across the Chasm…credibility!

Quantitative studies and refined marketing analytics models are virtually impossible for most companies to implement in house. Expertise, resource and budget constraints are perpetual challenges for marketing teams. Outsourcing analytics to specialist firms remove the time, cost and resource consumption required for in house analytics development, refinement and management. Research structure, key question formulation, and marketing refined analytics engines that uncover value attribution are not trivial actions. Quantitative studies are ideally outsourced to experts.

Outsourcing to specialist firms will:

• Deliver fact-based, statistically provable insights

• Turnkey solutions the result in immediately actionable insights – not just raw data

• Minimal commitment of staff time

• Eliminate the need to hire full time data analysts

The resultant findings can then be fed into the systems of business continuation (i.e. CRM, Martech stacks, etc.), where they can be leveraged as an additive to the marketing and sales action plan. Done correctly using marketing analytics professionals, the insights captured should have significant shelf life…which suggests outsourcing to experts on a project basis is the best course of action.

“The point of greatest peril lies in making the transition from early markets dominated by a few visionary customers to a mainstream market dominated by a large block of customers who are predominately pragmatists in orientation.” Geoffrey Moore

The good news for marketers is that refined, marketing specific analytics solutions are emerging, so the potential to strengthen perhaps the most important, yet weakest link in the Crossing the Chasm process exists. The bottom line is that even the best business book ever, and perhaps the most important tech company growth strategy ever documented can benefit from the progress made in analytics driven decisioning. Quantitative marketing analytics can reduce or eliminate the greatest chasm crossing peril!

Posted in: Blog